Private Markets & the Future of UK Pensions

EVENT OVERVIEW

This year’s forum brings together asset owners, policymakers, industry leaders and key advisers to explore how pension investment in private markets can drive better member outcomes and potentially national growth.

Against the backdrop of the Mansion House reforms, the Pensions Investment Review, the Pension Schemes Bill and evolving regulatory frameworks, the agenda tackles the practical realities of scaling private market allocations across DC, private DB and LGPS schemes.

It will include a series of presentations highlighting the special opportunities driven by UK research, innovation, and thought leadership across several key sectors.

The conference will be highly interactive, with open, thought-provoking content, encouraging participants to engage and contribute proactively throughout.

EVENT INFO

VENUE

The Private Markets Pensions Investment Forum will be held at Plaisterers’ Hall in London.

Attendance to the event is FREE for pension funds, employers, government representatives.

There is a modest fee for asset managers and consultants. You can contact us if you have any queries.

CPD

This event qualifies for 6 hours and 45 minutes of CPD credit. You can request CPD credit for the event when you register.

AGENDA

09:00 - 09:30

Registration & Refreshments

Networking Activity | Foyer | 09:00 – 09:30

Devil’s Advocates Panel

Sonia Bluzmanis

Head of Research – External Equities

Rest Super

Our morning Devil’s Advocates will challenge speakers with incisive questions throughout the sessions and present their key reflections and takeaways just before lunch.

Sonia Bluzmanis

Head of Research - External Equities

Rest Super

Sonia is the Head of Research, External Equities at Rest, based in London.

Sonia joined REST from BT Investment Group in May 2021, initially to take on the role of Head of Global Equities, with responsibility for managing REST’s 20Bil+ global equities asset class, the fund’s largest asset class by funds under management.

In 2022, Sonia relocated to London and was promoted to Head of Research, External Equities to lead the equity research program, providing advice on manager selection and construction, and market insights.

With over 17 years’ experience in investment management, Sonia has held senior roles specialising in investment research, fund manager selection and portfolio construction in several major financial institutions. Sonia holds a Bachelor of Commerce and a Bachelor of Arts (Asian Studies), with majors in Finance, Economics and Chinese (Mandarin) from Curtin University in Western Australia and holds the Certified Investment Management Analyst (CIMA) designation.

Established in 1988, REST is among the largest superannuation funds in Australia by membership, with approximately 1.9 million members and almost AU$90 billion in assets under management.

John Chilman

Independent Trustee

Nestlé UK Pension Fund

John has a portfolio of Non-Executive positions, having previously been the Chief Executive of Railpen, the Executive arm of the £35bn Railways Pension Scheme.

John has deep pensions and investment experience, and is currently Chair of the Pensions UK Policy Board, a member of the Pensions UK Board, a Trustee of the Pensions Policy Institute and an Independent Trustee Director of the Nestlé UK Pension Fund, where he chairs the DB Investment and DB Funding committees.

He has an MA in Geography from Oxford University and qualified as a Chartered Accountant with Price Waterhouse. In his corporate career John had roles in finance, change and M&A roles in South West Electricity and Shell, and pension, reward and leadership roles with FirstGroup, HBOS and National Grid.

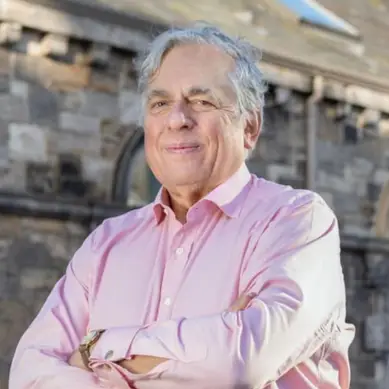

Mark Tennant

Trustee

Country Landowners Pension Fund

Mark Tennant is a Trustee of the Country Landowners Pension Fund, a Trustee of the Royal Hospital Chelsea and a Non-Executive Director of the Unit Trust of India International. He also leads a charity devoted to stopping young offenders from reoffending.

He previously served as the Chairman of Centrica Pension Funds, and Chairman of Scottish Land and Estates, after spending 28 years with J.P. Morgan Chase as a Senior Adviser, and CFO of the Global Custody Division.

Prior to that, Mark was at Hill Samuel, Fidelity and Hambros Bank, and served as the Conservative Party candidate against Gordon Brown in 1992 and against Winnie Ewing for the European seat of the Highland and Islands in 1994.

In the late 80’s, Mark served as the Treasurer for the Conservative Party for Scotland, and the Treasurer for the Better Together Campaign under Alistair Darling in 2014. He also served seven years in the Scots Guards, spent a year nursing in India, and is an Officer of the Queen’s Bodyguard in Scotland.

Away from work, his main interests are history, travel and Scottish music, particularly the Highland Bagpipe, which he plays.

09:30 - 09:45

Welcome & Introduction

Opening Remarks | Auditorium | 09:30 – 09:45

Event Chair:

Mark Thompson

Chair of Trustees

M&G Pension Scheme

Programme Director:

Stephen Glover

Founder & Chief Executive

SG Pensions Enterprise

09:45 - 10:15

The Opportunities for Private Markets Investing in the UK

Keynote Presentation | Auditorium | 09:45 – 10:15

In this opening keynote, our speaker will set the 2026 macro context for UK private markets, exploring how policy, growth dynamics and structural forces are shaping private capital opportunities and why private markets are becoming a core allocation for DB, DC and LGPS investors.

Sponsored by BlackRock

The Opportunites for Private Markets Investing in the UK

Keynote Presentation

Session Description

In this opening keynote, our speaker will set the macro context for UK private markets in 2026. Drawing on insights from the BlackRock Investment Institute, he will assess how an improving but fragile UK growth backdrop, evolving fiscal and policy constraints, and structural forces such as AI, energy transition and productivity pressures are reshaping demand for private capital.

The session will explore the role private markets could play in funding UK growth, the private market opportunities for UK investors today, and why private markets are becoming a core allocation for UK portfolios. Framing the key risks and opportunities facing DB, DC and LGPS investors, the keynote will provide the foundation for the discussions that follow.

Speakers in this Session

Devan Nathwani

Director - Investment Institute

BlackRock

Devan Nathwani FIA, Director, is a Portfolio Strategist in the Portfolio Research team of the BlackRock Investment Institute. The team is responsible for developing the core principles and intellectual property that underpin BlackRock’s approach to portfolio design, such as capital market assumptions and optimisation tools.

Prior to joining BlackRock in 2022, Devan worked at SECOR Asset Management, where he was an Investment Strategist, responsible for advising pension funds and other institutional clients on their strategic asset allocation and liability hedging arrangements.

Prior to SECOR, he began his career at Aon Hewitt in 2012, where he spent time in the Pensions Actuarial and Fiduciary Management teams.

Devan holds a Masters degree in Actuarial Finance from Imperial College Business School.

10:15 - 10:55

Aligning Policy Ambition with Pension Fund Reality

Panel Discussion | Auditorium | 10:15 – 10:55

This panel explores the growing tension between political ambition and fiduciary duty as UK policymakers push for greater domestic private market investment, examining whether pension schemes can align government expectations with member outcomes while still achieving impact and competitive performance.

Aligning Policy Ambition with Pension Fund Reality

Panel Discussion

Session Description

As the UK Government sharpens its focus on unlocking pension capital to fuel national growth, schemes are facing growing pressure to increase allocations to private markets in the UK.

With the Mansion House Accord setting voluntary targets and the Pensions Investment Review introducing reserve powers for potential mandates, the policy direction is clear.

Our speakers will explore the tension between political ambition and fiduciary responsibility, examining whether trustees can reconcile government expectations with their duty to act in members’ best interests. Through candid dialogue between a leading policymaker, an asset owner, a consultant and a manager, speakers will explore if policy goals and pension outcomes can align, and where private markets can deliver both impact and competitive performance.

Speakers in this Session

Mark Thompson

Chair of Trustees

M&G Pension Scheme

In addition to his role at M&G, Mark is a Member of the Independent Governance Committee at Zurich Insurance; Executive Chairman of the UBS (UK) Pension & Life Assurance Scheme Investment Committee; and a Member of the Investment & Funding and DC Committees at Lloyds Banking Group Pensions. He was previously the Chief Investment Officer of HSBC Bank Pension Trust (UK) Limited, who he joined in 2011.

Prior to this, he held a number of senior investment roles at Prudential/M&G. These included UK Equity Fund Manager, Head of Equity Research, Director of Collective Investments, and Investment & Strategy Director for Prudential Europe.

Fiona Frobisher

Head of Policy

The Pensions Regulator

Fiona is the Head of Policy at TPR, leading on changes to how TPR regulates areas such as value for money in DC schemes, funding for DB schemes and standards for trustees. She has more than 20 years’ experience in developing private pension standards and leading regulatory change. She is passionate about delivering pragmatic solutions which both protect members and work for those implementing them.

Fiona has recently returned from a loan as a Deputy Director at the DWP, where she led on the government response to effect of gilt rises on pension schemes, and way to ensure that pensions schemes including defined benefit schemes invest more productively.

Paul Forshaw

Chief Executive

Future Growth Capital

Paul is Chief Executive Officer of Future Growth Capital, a specialist private asset management business founded as a joint venture between Schroders and the Phoenix Group to serve UK pension clients.

Future Growth Capital’s mission is to deliver the objectives of the Mansion House Accord objectives, leveraging the deep investment and pensions expertise of Schroders and Phoenix. It manages multi–private asset solutions to unlock private markets for UK pension investors, investing across both UK and global private markets on behalf of the Phoenix Group / Standard Life and other UK pension clients.

Paul brings extensive experience across public and private markets, spanning both sell-side and buy-side roles. Prior to his current position, he served as Schroders’ Head of Strategic Partnerships, Global Head of the Insurance Asset Management business, and Chair of Schroders Pensions Management Limited, following earlier roles in the capital markets divisions of Goldman Sachs and BNP Paribas.

He holds a degree from Oxford University and a certificate in Mergers and Acquisitions from Imperial College Business School.

Ben Levenstein

Head of Private Markets

USS Investment Management

Ben is Head of Private Markets, overseeing a team investing across all private asset classes with a Net Asset Value of £25bn. Ben is also a member of the USS Investment Management Executive Committee and Asset Allocation Committee.

Ben joined Private Markets in 2013 and has led teams across the Strategic investment mandate, Co-Headed Real Assets and most recently was the Head of Private Credit and Alternative Investments, investing across the risk spectrum, both directly and through fiduciary managers. Ben has been a member of the Private Markets Investment Committee since 2010.

Prior to joining, Ben was Head of UK and European Equities at USS managing equity portfolios totalling £6bn. Ben began his career as an analyst at HSBC specialising in Utilities. He holds a BA in Business and Economics from the University of the West of England.

About Future Growth Capital

Future Growth Capital is an independent private markets solutions business formed by Phoenix Group, a leading long-term savings and retirement business, and Schroders, the UK’s largest listed asset manager, to deliver the Mansion House objectives.

Our mission is to unlock global private markets for UK pension savers. We aim to generate the higher investment returns they need to support their retirements and to invest long-term patient capital into UK businesses and development projects, helping to drive growth.

We serve UK pension funds looking to access private markets globally and international investors looking to access the UK’s private markets.

Our talented investment solutions team is one of the largest in the UK dedicated to serving the UK pensions industry. We design and manage private market investment solutions with the aim of harnessing the potential for higher returns, so that our clients can invest in private markets efficiently and with confidence.

Backed by the resources and reputations of Schroders and Phoenix Group, we are a partner our clients can trust for the long term.

For more details, please visit FGC’s website here.

Contact

10:55 - 11:20

UK Special Opportunities – Life Sciences

Presentation | Auditorium | 10:55 – 11:20

Sponsored by SV Health Investors

This session explores how the UK’s £100bn+ life sciences sector—Europe’s leading hub, underpinned by world-class research, NHS partnerships and government support — offers long-term institutional investors compelling access to high-growth innovation across biotech, genomics and advanced therapies.

UK Special Opportunity – Life Sciences

Presentation

Session Description

The UK Life Sciences sector offers a unique opportunity for long-term institutional investors seeking exposure to a high-growth, innovation-driven industry. Valued at over £100 billon annually and employing more than 300,000 people, the UK is Europe’s leading life sciences hub. With strengths in biotechnology, genomics, advanced therapies, and health data, the sector benefits from world-class research institutions, strong NHS partnerships, and significant government backing.

Speakers in this Session

Martin Turner

Director of Policy & External Affairs

BioIndustry Association

Martin leads the BIA’s policy and public affairs team, overseeing all of the BIA’s policy development work, Advisory Committees and engagement with government and other stakeholders.

He also supports Dan Mahony in his role as the Government’s Life Sciences Investment Envoy and leads BIA’s investor relations. He is chief editor of BIA’s finance reports and a regular commentator on the life sciences sector in the national media.

Outside BIA, Martin serves on the Advisory Board of the Cambridge University Science Policy Exchange (CUSPE). He has over fifteen years’ experience in policy and public affairs and has worked at the Royal Society, the Campaign for Science and Engineering, and the Association of Medical Research Charities. He holds a PhD in molecular biology from the University of Sheffield.

Kate Bingham

Managing Partner

SV Health Investors

Kate Bingham has spent over 30 years building and investing in biotech companies as Managing Partner at SV Health Investors, one of the longest tenured biotechnology investors globally.

These investments have resulted in the launch of 30 new innovative drugs including 6 new drug classes each addressing a major unmet medical need.

Kate also played an active role in setting up the Dementia Discovery Fund in 2017, focused on developing novel drugs targeting new biological mechanisms to treat dementia.

In May 2020, Kate was appointed the Chair of the UK Vaccine Taskforce, reporting to the Prime Minster to lead UK efforts to find and manufacture a COVID-19 vaccine. It was a pro-bono six-month engagement to December 2020. On 8 December 2020, the UK started COVID-19 vaccinations – the first western country to do so.

She serves on the board of the Francis Crick Institute and ARIA.

11:20 - 11:45

Networking Break

Networking Activity | Foyer

11:45 - 12:20

Pensions Reform, Private Markets & the Future

Fireside Chat | Auditorium | 11:45 – 12:20

This session examines how LGPS pooling is reshaping private markets investing — transforming governance, fees, risk management and access to sophisticated strategies — while unlocking new opportunities for direct and local investment.

Pensions Reform, Private Markets & the Future

Fireside Chat

Session Description

This session brings together two leading figures who have been at the forefront of shaping the current pensions landscape.

The discussion will delve into the major policy shifts that have set today’s direction of travel, including the pensions freedoms and auto-enrolment, the reshaping of DB, the emergence of LTAFs, and the creation of LGPS pools. It will embrace how these reforms are playing out in practice across the LGPS, DC and corporate DB sectors, especially in the context of private markets.

Expect a candid exploration of the pressures and opportunities created by the Government’s agenda: accelerating consolidation, and the push for greater private-market investment embodies by the LGPS “Fit for the Future” programme, and the Mansion House Accord.

Speakers in this Session

Guy Opperman

Former Pensions Minister

UK Government

Chris Hitchen

Chair

Nuclear Liabilities Fund

Chris is an actuary with over 37 years of experience in investing assets to meet long-term liabilities.

As well as the Nuclear Liabilities Fund, he sits on the Board of the Scott Trust Endowment Ltd, which backs the Guardian and Observer newspapers.

Chris is a Fellow and a member of the Finance and Investment Board of the Institute and Faculty of Actuaries. He is also a Governor of the Pensions Policy Institute and is an Honorary Fellow and member of the Fellowship Committee of the CFA UK Ltd.

Chris is a former Chair of the Pensions and Lifetime Savings Association and in 2012 was appointed by BEIS as an advisor to Professor John Kay for his review of short-termism in the UK stock market. For almost 20 years, Chris led Railpen, the £30 billion industry-wide pension scheme for the UK rail industry.

Jamie Broderick

Board Director

Impact Investing Institute

Jamie Broderick is the Deputy Chair and Board member at the Impact Investing Institute, an independent, non-profit UK organisation that aims to accelerate the growth and improve the effectiveness of the impact investing market. The Institute is supported by the UK’s Government Inclusive Economy Unit, the City of London Corporation, and a number of financial services organisations in the UK.

Jamie was head of UBS Wealth Management in the UK from 2013-2017. Jamie joined UBS after nineteen years at J.P. Morgan Asset Management, latterly as Chief Executive of its European operations. He joined J.P. Morgan in New York in 1993 and moved to London in 1996. He started his financial services career at Wellington Management Company, an independent asset management partnership in Boston.

He studied Arabic Linguistics and Near Eastern Languages and Civilizations at Harvard College and continued those studies in a Ph.D. program at the University of Chicago.

Guy Opperman

Former Pensions Minister

UK Government

12:20 - 12:45

UK Special Opportunity – Social Housing

Presentation | Auditorium | 12:20 – 12:45

This session outlines why social housing offers pension schemes the opportunity for superior investment returns to benefit members whilst delivering measurable social impact in a sector backed by urgent need and supportive government policy.

Sponsored by PATRIZIA

UK Special Opportunity – Social Housing

Presentation

Session Description

Social Housing offers pension investors a rare combination of compelling returns and measurable social impact.

The need is urgent: over 1.3 million households remain on waiting lists in England, with 123,000 families in temporary accommodation, including 160,000 children, costing the government nearly £2 billion annually. Yet only 9,866 new homes for social rent were delivered in 2023–24 against an annual requirement of 90,000.

Government policy is supportive, with a £39 billion commitment over 10 years. For pension schemes seeking compelling returns that are Mansion House aligned, social housing provides the opportunity for superior return, ESG alignment, and the chance to address one of the UK’s most pressing challenges.

Our speaker will make the case for the most viable investment opportunities in social housing for pension funds, highlighting strategies that combine financial resilience with meaningful social impact.

Speakers in this Session

Simon Redman

Managing Director – Global Head of Product, Patrizia

Simon Redman

Managing Director – Global Head of Policy

Patrizia

Simon Redman leads product strategy at PATRIZIA, bringing more than three decades of experience in investment, strategy and product development across global real assets markets.

He is widely recognised for his ability to translate market themes into scalable investment solutions, with a strong track record serving institutional , DC and Wealth investors.

Simon has played a pivotal role in bringing institutional quality investment strategies to Defined Contribution and wealth management investors. He designed and launched a range of innovative global real estate strategies that opened new avenues for private market access. Earlier in his career, Simon spent 18 years as a member of Invesco Real Estate’s European Executive Management and Investment Committees, helping to catalyse the growth of the platform in the years following the global financial crisis.

Simon is responsible for shaping PATRIZIA’s product strategy across real estate, impact and infrastructure. His focus includes developing new investment solutions and strengthening capital formation capabilities in close collaboration with senior leadership. His role supports the ongoing evolution of PATRIZIA’s product architecture to meet the needs of a broader and increasingly diverse investor base.

Redman’s role underscores PATRIZIA’s commitment to delivering long-term value through a high-quality, diversified real assets platform. His expertise is instrumental in advancing the firm’s five strategic growth priorities: Living, Value-add, European infrastructure (debt and equity), RE-Infra, and Advantage Investment Partners, PATRIZIA’s independent club investment platform.

About Patrizia

Future Growth Capital is an independent private markets solutions business formed by Phoenix Group, a leading long-term savings and retirement business, and Schroders, the UK’s largest listed asset manager, to deliver the Mansion House objectives.

Our mission is to unlock global private markets for UK pension savers. We aim to generate the higher investment returns they need to support their retirements and to invest long-term patient capital into UK businesses and development projects, helping to drive growth.

We serve UK pension funds looking to access private markets globally and international investors looking to access the UK’s private markets.

Our talented investment solutions team is one of the largest in the UK dedicated to serving the UK pensions industry. We design and manage private market investment solutions with the aim of harnessing the potential for higher returns, so that our clients can invest in private markets efficiently and with confidence.

Backed by the resources and reputations of Schroders and Phoenix Group, we are a partner our clients can trust for the long term.

For more details, please visit FGC’s website here.

Contact

12:45 - 12:55

Devil’s Advocates Summary

The Devil’s Advocates will give their summary of the main debating points, conclusions and action points from the morning sessions.

12:55 - 13:45

Lunch

Devil’s Advocates Panel

Throughout the afternoon, our panel of Devil’s Advocates will challenge speakers with thought-provoking questions and close the day by sharing their key insights and takeaways from the discussions.

Nicolas Firzli

Director General

World Pensions Council

Nicolas is the Founder of the World Pensions® Council, the retirement & savings industry group, co-chair of the G7 Pensions Roundtable held on the sidelines of the G7 Summit, founding-member of the Advisory Council for the Global Infrastructure Facility (GIF), a World Bank and G20–led global initiative, and executive director of the Singapore Economic Forum (SEF).

He has co-developed notions such as ‘SDG–Driven Investment’, ‘Pension Superpowers’, the ‘Age of Geoeconomics’, ‘Employee Capitalism’, and chaired the Pensions and Asset Owners Roundtable at the 2015 UN Climate Change Conference (Paris COP21 Summit/Paris Agreement).

Nicolas is a graduate of Canada’s McGill University (Statistics & Financial Economics), an alumnus of the HEC Paris School of Management (MBA Corporate Strategy & Marketing) and the University of Paris Law School (LL.M. Corporate Law) and has conducted research at the University of Louvain (UCL) Doctoral School of Economics and Management in Waals Brabant (Belgium).

He is a regular contributor to BBC News (Asia), Asharq News with Bloomberg, the Arabian Gulf financial news network, RTÉ, Ireland’s National Television and Radio Broadcaster, and Cairo TV (Qahera News).

He is also active in ecumenical, intercultural dialogue, nonalignment, & the promotion of peaceful, inclusive sustainable development endeavours in Britain, the European Union (EU) and the Greater MENA–APAC continuum.

Andrew Carrett

Managing Director

Flint Hyde

Andrew has over 25 years’ experience in financial services executive search and has been with Flint Hyde for more than 16 years.

As Managing Director of the firm’s Financial Services Practice, he specialises in Board, Non-Executive, and Advisory appointments across the full spectrum of financial services, with particular expertise in reinsurance, investment, and asset management.

Andrew has a strong track record of delivering complex, high-impact searches across global markets, and is known for his meticulous, research-driven approach and long-term client partnerships.

“Having worked in search through several market cycles, I’ve seen first-hand how vital the right leadership can be in shaping a firm’s future – whether that’s steering through regulatory changes, accelerating growth, or driving cultural change. What continues to motivate me is the opportunity to partner with businesses at pivotal moments and help them identify talent that genuinely makes a difference.

Over the years, I’ve built long-standing relationships with both clients and candidates, many of whom I’ve worked with repeatedly as their careers and organisations have evolved.”

Kirsty Wilman

Chief Operating Officer

Rebalance Earth

Kirsty is the Chief Operating Officer at Rebalance Earth as well as chairing the Investment Committee. She has over 20 years’ experience across private markets operations, finance, governance, and audit, with a particular focus on institutional real asset strategies.

She spent over 14 years at Federated Hermes, holding senior roles including Real Estate Chief Operating Officer, Private Markets Head of Operations, and Director of Finance & Operations for Real Estate. Across these roles, Kirsty was responsible for building and operating institutional fund platforms, supporting investment committees, overseeing complex fund structures, and ensuring robust control, reporting, and governance environments.

Kirsty is a Fellow of the ICAEW, holds the Investment Management Certificate, and has over eight years’ experience in audit and financial control roles, providing deep expertise in assurance, valuation oversight, and operational risk management. She also serves as a Non-Executive Director of Tritax Big Box REIT plc, a FTSE 250-listed company, and a member of the Audit Committee and Management Engagement Committee.

13:45 - 14:10

The Role of the Regulators in the Growth of Private Market Investments

FIRESIDE CHAT | Auditorium | 13:45 – 14:10

This fireside chat will explore how the Financial Conduct Authority and The Pensions Regulator are working together to support government ambitions for greater consolidation and increased investment in UK private markets, while ensuring strong governance, fiduciary responsibility and member outcomes remain central.

The Role of the Regulators in the Growth

of Private Market Investments

Fireside Chat

Session Description

Given the government initiatives to drive pension scheme consolidation (£25bn in default arrangements by 2030) and greater investment especially in private markets (Mansion House Accord), how are the pension regulators (TPR and FCA) working together to both support the government agenda whilst helping to ensure fiduciary responsibility is maintained.

Speakers in this Session

Nike Trost

Head of Department – Wholesale Buy Side Market Analysis & Policy

Financial Conduct Authority

As Head of Department, Nike is responsible for delivering the FCA’s strategy and risk outlook in relation to the asset management sector, policy approach to asset management and FCA regulated pensions.

Nike has 20 years regulatory experience gained from working across the FCA, including in overseeing asset management supervision, various capital market policy roles, oversight of primary capital markets transactions and heading the FCA’s prospectus approval function.

Brendan Walshe

Principal – Investment Consultant

The Pensions Regulator

Brendan joined The Pensions Regulator in March 2015 and is a member of the Regulator’s Investment Consulting Team.

Within his current role, he acts as an adviser within TPR and provides advice on DB investment and funding strategies and contributes to the regulation of DC pension schemes. Brendan also provides specialist investment input to TPR’s regulatory policy and publications, including DB and DC Codes of Practice and regulatory guidance.

Prior to joining the regulator, he worked with a number of leading consultancies providing advice to private and public sector clients on all aspects of pension scheme investment, risk management and governance.

Brendan has regularly spoken at industry conferences and contributed to a range of industry publications.

He is a Fellow of the Institute of Actuaries and has contributed to a range of Institute working parties

14:10 - 14:45

Private Markets in DC – Balancing Ambition, Duty & Impact

Panel Discussion | Auditorium | 14:10 – 14:45

This panel examines how UK DC schemes can integrate private markets into their investment strategies in the wake of the Mansion House Accord, balancing fiduciary duty with innovation as speakers explore meaningful allocation levels, long-term value, sustainability goals, and the practical frameworks needed for successful adoption.

Sponsored by Apollo Global Management

Private Markets in DC – Balancing Ambition, Duty & Impact

Panel Discussion

Session Description

This panel will explore the evolving role of private markets within UK DC schemes, spanning single-employer trusts, master trusts, and contract-based arrangements, against the backdrop of the Mansion House Accord.

While the Accord signals a major policy shift, fiduciary duty remains paramount, requiring trustees and providers to balance innovation with member best interests.

Our speakers will examine how allocations to private markets can deliver long-term value while advancing sustainability goals. The discussion will address what a ‘meaningful’ allocation to alternatives looks like, as well as the opportunities, challenges, and frameworks needed to make private markets a cornerstone of DC investment strategy.

Speakers in this Session

Stephen Budge

Head of DC Investment Strategy, LCP

Veronica Humble

Chief Investment Officer, NatWest Cushon

Ruari Grant

Head of Policy & External Affairs

TPT Retirement Solutions

Ruari is Head of Policy and External Affairs at TPT, which he joined in October 2025, and is responsible for looking after external engagement on policy issues across DB, DC and CDC.

Prior to TPT, he was Head of DC & Master Trust at Pensions UK, leading the policy team’s work on topics including decumulation, value for money, scale/consolidation and DC investment.

Before Pensions UK, he spent seven years working in policy and public affairs at Standard Life and Aberdeen.

Stephen Budge

Head of DC Investment Strategy

LCP

Stephen leads LCP’s DC Team’s focus on DC investment strategy design, which means much of his time is spent looking at the evolving area of private markets.

He is actively involved in a number of industry organisations and taskforces which share the same ambition of improving member outcomes. This includes working with the DCIF’s Advisory Committee, the Treasury’s Productive Finance Working Group which concluded in 2022, development of the Mansion House Compact and TPR private market guidance and now the FCA’s VFM Investment Performance Industry Working Group.

Stephen’s clients include schemes of all sizes including large single sponsor arrangements as well as several Master Trust arrangements. Over the years, many of his clients have been pushing the boundaries of DC investment design, through illiquid holdings or new approaches to DC investment strategy design, leading to two innovation awards and more recently, Scheme of the Year, from Professional Pensions.

Veronica Humble

Chief Investment Officer

NatWest Cushon

Veronica Humble leads NatWest Cushon’s investment function and is a strategist for Cushon Master Trust.

Prior to this role, she was Head of DC Investments at Legal and General Investment Management and held a number of roles across LGIM’s Investments and Distribution before that.

She started her career as a quantitative analyst in Phoenix Group. She has MSc in mathematics and a PhD in statistics.

Jesal Mistry

Managing Director – UK Defined Contribution

Apollo Global Management

Jesal Mistry is a Managing Director and Defined Contribution Lead for the UK at Apollo Global Management.

In this newly created role, he is responsible for driving the growth of Apollo’s defined contribution (DC) business across the UK and Europe — expanding access to Apollo’s investment capabilities and product suite for DC stakeholders including trustees, consultants, and platform providers.

Based in London, Jesal sits within Apollo’s Defined Contribution team in the firm’s New Markets business, led by Partners and Co-Heads Neil Mehta and Jon Godsall. He brings more than two decades of UK DC experience and joins Apollo from Legal & General, where he was most recently Head of Defined Contribution Investment and helped lead the launch of the firm’s private markets offering for DC investors.

Jesal is widely recognized as a thought leader on evolving DC investment solutions — including broadening high-quality diversification opportunities for DC savers — and has been an advocate for thoughtfully expanding DC access to private markets.

About Just Group

For more details, please visit Just Group’s website here.

Contact

14:45 - 15:10

Can the Private Securities Market be a Game Changer for Pensions?

Presentation | Auditorium | 14:45 – 15:10

This presentation explores why valuation practices, fee structures and fund design are central to private markets investing, examining how trustees can navigate complexity and data to ensure transparent, fair and sustainable outcomes for members.

Can the Private Securities Market be a Game Changer for Pensions?

Presentation

Session Description

LSEG’s Private Securities Market is designed to bring public-market discipline and efficiency to private assets, creating a regulated environment where issuance, onboarding, and secondary transfers become far simpler and faster. This structure is intended to markedly improve upon the bespoke, high-friction processes that have long slowed private-market transactions and limited liquidity.

Our speaker will emphasise the pivotal role of asset-owner participation in deepening liquidity pools and setting the governance standards to make this system effective. He will focus on how this market infrastructure can help remove key barriers that currently constrain UK pension fund allocations to

private markets, particularly venture capital, by improving transparency, reducing operational drag, and opening clearer pathways to liquidity.

Speakers in this Session

Tom Simmons

Director – Private Markets Product Development

London Stock Exchange Group

Tom focuses on product development covering London Stock Exchange’s equity capital markets, leading on the Exchange’s development of Private Securities Market, a crossover market seeking to join up private and public markets which has received FCA approval under HMT’s PISCES regulatory framework.

Tom has been at the exchange for over 12 years, working within regulatory, policy and product roles spanning LSE’s AIM and Main Market trading venues focusing on primary market development.

Prior to joining London Stock Exchange, Tom became a Chartered Accountant, working in PwC’s Insurance and Investment Management practice.

About Just Group

For more details, please visit Just Group’s website here.

Contact

15:10 - 15:35

Networking Break

Networking Activity | Foyer | 15:10 – 15:35

15:35 - 16:15

The Critical Decision Factors in Private Markets Investing

Roundtable Discussions | Auditorium | 15:35 – 16:15

Roundtable Facilitator:

Shalin Bhagwan

Chief Actuary

Pension Protection Fund

This interactive session brings asset owners together to debate the key decision factors shaping private market allocations—from fiduciary duty and hurdle rates to valuation, liquidity, scale and vehicle choice—culminating in table-wide conclusions on the viability of private markets across LGPS, DB and DC schemes.

The Critical Decision Factors in Private Markets Investing

Roundtable discussions

Session Description

Following a scene-setting introduction, a Moderator at each table will lead a discussion on the key decision factors facing asset owners in allocating to private markets, especially in light of the Government’s initiatives in this area. These will embrace fiduciary duty, due diligence costs, required hurdle rates, valuation methodologies, liquidity and scale considerations and appropriate investment vehicles, while taking account of the different priorities and constraints for LGPS, Corporate DB and DC schemes.

Several of the Moderators will be called upon to summarise their conclusions to the overall conference on the viability of Private Markets investing.

Speakers in this Session

Roundtable Facilitator:

Shalin Bhagwan

Chief Actuary, Pension Protection Fund

Shalin Bhagwan

Chief Actuary

Pension Protection Fund

Shalin joined the Pension Protection Fund (PPF) in 2023, where he serves as Chief Actuary and interim Chief Financial Officer.

At PPF, he brings extensive pensions, insurance and investment experience, having previously worked at DWS Investments since 2018, and other companies across the sector for many years. He originally started his career in South Africa in life insurance pricing and reserving and then transitioned into liability valuations for defined benefit pension funds.

In addition, he brings significant LDI, derivative and credit portfolio management experience and has advised some of the UK’s largest pension funds on their LDI strategies both as a consultant with Mercer and portfolio manager with Legal & General Investment Management.

Shalin is a member of the Advisory panel at the Financial Reporting Council. He recently served as a member of the Institute and Faculty of Actuaries’ Finance and Investment Board and as an advisory member for the task force to boost socio-economic diversity at senior levels in both the financial and professional services sectors.

Shalin is a Fellow of the Faculty of Actuaries and holds an Honours Degree in Statistics and Actuarial Science from the University of Cape Town.

Martin Bailey

Chair

Lambeth Pension Fund

Martin Bailey delivers capital alignment at scale.

He was a lead architect of the Mansion House Accord and the Compact before it, working across government and industry to unlock billions in pension fund investment into productive assets.

At the City of London Corporation, he leads engagement with institutional investors, global firms, and policymakers. He also chairs the £2bn Lambeth Pension Fund, pushing forward investment in private markets, climate risk, and good stewardship.

Mark Hedges

Trustee Director

Nationwide Pension Fund

Mark is a Trustee and former Chief Investment Officer of the Nationwide Pension Fund, where he had responsibility for the performance and implementation of the asset allocation strategies agreed with the fund investment advisors.

Previously, he led the establishment of Nationwide’s Covered Bond programme and its Silverstone RMBS Master Trust funding vehicle. In addition, Mark has securitised UK Student Loans and a synthetic corporate bond structure along with structured transaction and investment in various ABS instruments. Past experience also includes leading the origination and structuring of social housing, PFI and commercial real estate debt transactions.

Martyn James

Director of Investment

NOW: Pensions

Martyn James is the Director of Investment at NOW: Pensions, the UK master trust provider.

Martyn is responsible for leading the investment strategy for the business, with a focus on improving returns and retirement outcomes for its members, and enhancing the sustainability characteristics of the portfolio.

Martyn joined NOW: Pensions in April 2024. Prior to joining NOW: Pensions, he spent 22 years at Mercer, most recently as a partner within Mercer’s UK DC business, but also with a recent two and a half year secondment, leading Mercer’s Wealth (Pensions and Investments) business in Latin America.

Fattah Rinol

Investment Manager

Nestlé UK

David Linehan

Private Markets Adviser

Independent

Jo Waldron

Trustee Director

Prudential Pensions Scheme

Jo joined M&G Investments in February 2012 to begin work as a Director in the Alternative Credit Team.

In that role, she developed a £10bn range of diversified private debt products for institutional clients. She had oversight of the end to end journey for clients investing in Private Credit Products.

In 2024, Jo transitioned into a newly created role leading M&G’s efforts to develop broad Private Markets offerings for new client types that have requirements which are not met by traditional closed-ended funds.

Since 2020, Jo has served as a Trustee Director for the Prudential Staff Pension Scheme, sitting on the investment committees for both DC and DB sections and the main trustee board. In 2024, she became Chair of the DC Section.

Jo began her career at HSBC in 2001, holding various roles over 10 years, primarily in investor relations for the ABS Investments team and later as an investment specialist in Global Fixed Income and Global Sales Management.

She holds a PhD in Chemistry from the University of London.

16:15 - 16:40

UK Special Opportunity 3 – Private Credit

Presentation | Auditorium | 16:15 – 16:40

This session explores the rapid growth of private credit and its rising role in UK pension portfolios, assessing how schemes can access diverse lending opportunities to capture strong risk-adjusted returns while balancing liquidity needs and long-term resilience.

UK Special Opportunity 3 – Private Credit

Presentation

Session Description

Private Credit has emerged as one of the fastest-growing segments in global private markets, now exceeding $1.5 trillion in AUM and projected to reach $2.6 trillion by 2029. In the UK, tighter bank regulations and persistent refinancing needs have created a robust pipeline for direct lending, opportunistic credit, and specialty finance strategies.

For pension schemes, private credit can offer attractive risk-adjusted returns. Beyond income generation, private credit enhances diversification and resilience, making it a compelling complement to traditional fixed income.

Our speaker will outline how pension investors can access these opportunities efficiently, balancing liquidity needs with long-term growth potential.

Speakers in this Session

Speaker TBC

Tom Collier

Managing Director

Apollo Global Management

Tom Collier joined Apollo in 2024 as a Managing Director in the Client and Product Solutions group in Europe, where he is a Product Specialist focused on Asset Backed Finance strategies.

Prior to joining Apollo, Tom was an Executive Vice President at PIMCO, where he served as an Alternatives Strategist from 2012 to 2024. At PIMCO, he was a product specialist for various private credit, opportunistic and hedge funds in EMEA, and was responsible for product development in Europe. From 2001 to 2012, Tom worked at alternative investment management subsidiaries of HSBC and Bank of New York Mellon, having begun his career at Barclays.

He received a B.Sc. from University College London.

17:05 - 17:35

From Innovation to Impact – Unlocking the UK's Economic Future

Closing Presentation | Auditorium

This session makes the case for transforming the UK’s world-leading innovation in fintech, life sciences, AI, quantum and more into long-term national prosperity, arguing that political reform, public–private partnership and better links between invention and investment are essential to avoid past mistakes and unlock sustained economic growth.

From Innovation to Impact – Unlocking the UK's Economic Future

Closing Presentation

Session Description

The United Kingdom stands at a crossroads where its world-class thought leadership in Fintech, Life Sciences, Artificial Intelligence, Quantum Technologies and others must finally be translated into sustained prosperity for all. Our speaker will advocate how this requires more than rhetoric. It will demand political courage, economic foresight, structural reform, and organisational agility. It means forging a genuine partnership between public and private sectors, where government sets the enabling framework and industry drives innovation at scale. The supply of opportunities will come from our universities, our start-ups, our laboratories, and our entrepreneurs, but only if we build the bridges that connect invention to investment. Our speaker will show how we can avoid the errors of the past – fragmentation, undercapitalisation, and short-termism – to ensure that Britain’s ingenuity is not just admired, but monetised, multiplied, and made to serve the enduring prosperity of society.

Speakers in this Session

Speaker TBC

Sir Sherard Cowper-Coles

Former British Ambassador

UK Foreign Office

Sherard worked at HSBC as a full-time employee from 2013 to 2023, initially as Senior Adviser to the Group Chairman and Group Chief Executive, and for eight years heading the Group’s Global Government and Public Affairs functions. On his retirement, on 31 December 2023, he was engaged as Senior Adviser to the Group.

Earlier, he spent over 30 years in the British Diplomatic Service, which he joined straight from reading Classics at Oxford. He finished his career as Ambassador to Israel, Saudi Arabia and then Afghanistan.

Sherard is Chair of the China-Britain Business Council; Honorary Vice President of the UK Financial Inclusion Commission; and a Committee Member of The Hong Kong Association. He is an Ambassador for the Winston Churchill Memorial Trust. He is a member of the fundraising committee for Maggie’s charity, and a Trustee of Arundells, the Sir Edward Heath Charitable Foundation. He is President of The Kilvert Society.

Sherard is the author of two books: Cables from Kabul and Ever the Diplomat.

16:40 - 16:50

Devil’s Advocates Summary

The Devil’s Advocates will give their summary of the main debating points, conclusions and action points from the afternoon session.

16:50 - 17:00

Chair's Summary

Closing Remarks | AUDITORIUM | 16:50 - 17:00

The Chair will conclude the day’s proceedings and reflect on the various opinions discussed throughout the day.

17:00 - 18:30

Drinks Reception

Networking Activity | Foyer | 17:00 - 18:30

Following conclusion of the conference, delegates are invited to stay for drinks and network with fellow members of the industry.

Venue

Plaisterers' Hall

This event will be held at Plaisterers’ Hall in London.

Plan your journey via Transport for London.

Travel & Access

Tube: St Paul's (Central) - 5 mins; Mansion House (Circle / District) - 10 mins

Nat Rail: City Thameslink (Elizabeth / Thameslink) - 5 mins